Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

About Missouri's Uninsured Motorist Insurance Coverage

Uninsured motorist coverage protects an insured individual who is injured in an accident caused by a driver who had no insurance. Uninsured motorist insurance is essentially a floating, personal accident insurance that follows the insured wherever they go, as opposed to an insurance on a particular vehicle. The rationale behind uninsured motorist insurance coverage is to offer any injured person, who was injured by an uninsured motorist, the same protection they would be entitled to if they had been injured by someone who did have liability insurance.

Required by state law, Missouri has the following minimum insurance coverage requirements:

- $25,000 per person for bodily injury,

- $50,000 per accident for bodily injury,

- And, $25,000 per accident for property.

Normally, if you were ever in a car accident that wasn’t your fault, you would write down the at-fault driver’s insurance information, file a claim with their insurance company, and receive compensation from their insurance company for any damages. The issue is that not every driver has insurance, and in some instances, a driver may leave before you get their information. That is where this law comes in. Your uninsured motorist coverage is there to financially protect you from those irresponsible drivers.

Example claim: Uninsured motorist coverage is triggered when you are involved in an accident with a driver who does not carry liability insurance, and when that driver is at fault for the accident. Meaning that uninsured motorist coverage is not triggered in accidents where you are at fault. For example, the most common accidents that trigger uninsured motorist coverage are those where the driver responsible for the collision does not carry liability insurance at all and/or hit-and-run accidents where the driver cannot be found.

Missouri residents involved in an accident may file an uninsured motorist claim with their own insurance company in the following situations:

- The insured sustained bodily injuries,

- Those injuries occurred because of an accident with an uninsured motorist (please note that your insurance company may require proof that the at-fault driver was uninsured – this can be a report from the DMV that confirms the driver was uninsured),

- The insured is “legally entitled” to collect from the uninsured motorist ,

- And, all applicable policy limits are first exhausted by payment or settlement.

Exceptions to Uninsured Motorist Coverage & Insurance

- If the insured is at fault: Uninsured motorist coverage is not triggered if the accident was your fault. That coverage is only provided if the uninsured driver was responsible for the collision. This is why insurance companies will thoroughly investigate the cause of an accident. Insurance companies want to avoid paying you damages under your uninsured motorist policy so they always will do their due diligence in investigating.

- Passengers in non-owned vehicles: If you are a passenger in a vehicle that is not owned by you at the time of the accident, it is unlikely that your uninsured motorist policy will cover your injuries.

- Unidentified/phantom vehicles: If you cannot establish the presence of another vehicle, or if the damage to your vehicle and your injuries were not caused by your fault, your uninsured motorist claim will likely be denied. This is to prevent fraudulent claims such as a person being involved in a single-car accident, but telling their insurance company it was caused by a hit-and-run driver. Proving that another vehicle was involved in your collision is not the same as being able to locate and identify the driver. Even in a hit-and-run accident where the driver cannot be found, you should still be able to prove that another vehicle caused your injuries through street cameras, a police report, eyewitnesses, etc.

- Uninsured but other driver at fault: Even if you are uninsured but the other driver is at fault, you can seek compensation for economic damages if the other driver is at fault. However, the compensation you are available to recover will be limited.

What Happens If The Driver Who Hit Me Is Uninsured?

If you or a loved one has been injured in an accident involving an uninsured or underinsured motorist, you may be eligible to recover compensation with an uninsured or underinsured motorist claim.

No matter the circumstances, being involved in a motor vehicle accident is a stressful situation. When you are hit by a driver that does not have insurance coverage, it can make a bad situation seem even worse. You may be unsure of what to do if you find yourself in this dilemma. At Brown & Crouppen, your car accident lawyer is experienced at handling these types of car accident lawsuits.

Here are a few tips to help guide you through the process.

Step #1: Report The Accident To Law Enforcement

It is vital to your claim that you report being involved in an accident to the police. You may feel compelled not to do so if the other driver tells you they do not have insurance or tries to convince you not to report it. It is also possible that the other driver may try to simply exchange insurance information without involving the police. This is not in your best interest. The insurance information that was provided to you may not be valid. Without a police report, it will be very difficult to pursue a claim. The police report is key evidence to support that you were involved in an accident. Typically, the police report will determine who was at fault and confirm if the insurance information provided is valid.

Step #2: Document Any Injuries & Property Damage

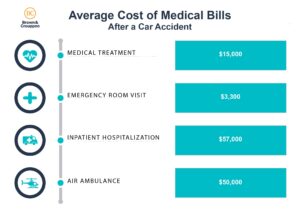

Seek medical treatment right away if you are injured. Keep track of your doctor’s appointments and of any symptoms you are experiencing. You should also keep documentation of any time missed from work because of your injuries. Your attorney and paralegal will need this information for your claim to support your damages. This will also assist your legal team to collect your relevant medical bills and records from your treating doctors and request wage loss documentation from your employer on your behalf.

In addition to documenting any injuries sustained in the accident, it is extremely important that you take pictures of the damage to your vehicle and the other vehicle involved, if possible. Property damage photos are helpful because they can help the insurance adjuster assess the severity of your injuries based on the impact to the vehicle.

Step #3: Report The Accident To Your Insurance Company

You will need to contact your insurance company as soon as possible to inform them you were involved in a motor vehicle accident and that you were hit by an uninsured driver. Do not give a recorded statement to your insurance company without first consulting with your attorney. Your insurance company will help determine what insurance coverage you have available.

Step #4: Considering Ramifications For The Uninsured Driver

As soon as your paralegal is aware of a potential Uninsured Motorist claim, they will discuss with the attorney to determine if the attorney would like an uninsured investigation to claim to be filed with the State’s DMV office. The DMV can sometimes obtain insurance information that we were not able to access. If it is determined that the at-fault driver is unable to prove they had insurance coverage, then the DMV will usually suspend the individual’s driver’s license.

Step #5: Determine Your Legal Options

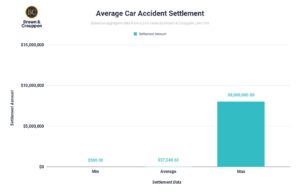

If you have been hit by an uninsured or underinsured motorist, you may be eligible to recover compensation for damages including medical bills, lost wages, property damages, and pain and suffering. If you or a loved one has been injured in an underinsured / uninsured motorist accident, request a free case evaluation from an attorney to better understand your legal options.

Step #6: Understanding Insurance Coverage Options

- Medical Payments Coverage: Medical payments coverage is optional for an additional premium in Missouri and Illinois. This is typically a “no-fault” coverage and it will help cover the costs of any related medical expenses for you and any passengers in your vehicle that were injured during an accident, up to the medical payment limits you have on your policy. Your paralegal can assist you with submitting your medical bills and records to your insurance carrier and collecting your medical payments benefit. This is separate from any liability claim you may have.

- Collision Coverage: Collision coverage is another optional coverage you may have added on to your insurance policy. If you have Collision coverage, this will help pay for any property damage to your vehicle up to the policy limit, regardless of who is at fault. Collision coverage will not pay for any of your medical expenses.

- Uninsured Motorist Coverage: Generally, when you are hit by someone else and it is their fault, a claim is filed with the at-fault driver’s liability insurance. But if it is determined that the driver that hit you was uninsured, then an uninsured motorist claim is filed with your insurance carrier.

Both Missouri and Illinois require vehicle owners to carry a minimum of $25,000 per person and $50,000 per accident for uninsured motorist coverage. This coverage gives you protection when the at-fault party does not have insurance and can also sometimes apply if the accident was caused by a hit-and-run or a “phantom driver”. Since your insurance company is now stepping in and taking over the role of the typical at-fault’s liability insurance, they will often try to minimize the amount to pay for your claim. An experienced attorney understands how the process works and will be able to consult with you about your options to recover the maximum amount for your injuries.