This protects injured persons if the driver holding the insurance policy causes a crash. In Missouri, an injured person may file their claim for bodily injury or property damage against the liability coverage of the driver who caused the crash without going through their own insurance company first. “At-fault” and “no-fault” are terms that refer to the type of insurance system for any given state in the United States, and they determine how auto accident claims are handled.

Most no-fault states require insurance companies to provide coverage (often called Personal Injury Protection, or first-party coverage) to cover the policyholder’s injuries in a crash. In no-fault states, everyone must use their own car insurance to pay for their damages and injuries, regardless of who caused the wreck. If a person’s injuries exceed their no-fault coverage, they may be able to make a claim against the other driver’s policy, but many states limit the amount that can be recovered.

WHAT HAPPENS IF THE PERSON AT FAULT HAS NO INSURANCE?

A driver who does not have insurance at all may be unable to pay for the injuries and damages that result from a car crash. In this situation, an injured person may make an Uninsured Motorist (UM) claim on their own automobile insurance. Many states require insurance companies to provide UM coverage with all auto policies. Missouri’s uninsured motorist statute requires that all drivers must maintain UM coverage.

UM coverage is important for every driver to have because it ensures some level of compensation for injuries if the at-fault driver was not carrying insurance at the time of the crash.

Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

HOW DOES AT-FAULT INSURANCE IMPACT CAR ACCIDENT CLAIMS?

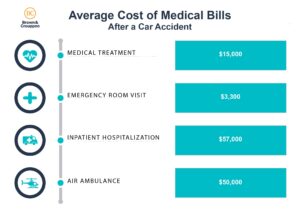

In an at-fault state like Missouri, whoever caused the crash is responsible to pay for the injuries and damages they caused. Typically, a claimant (the person filing the claim) expects to recover a certain amount of money to compensate them for their damages. Damages typically fall into two categories: economic damages (things like medical bills and lost wages), and non-economic damages (things like physical pain and suffering, mental anguish, and loss of a normal life).

As we learned above, people hurt in a crash can file their injury claims against the liability coverage of the driver who caused the crash. However, it may not always be clear who is at fault, and this can affect how much money an injured person can recover.

For example, if there is more than one driver at fault, then the injury claims will be handled by each at-fault driver’s insurance policy according to what portion of fault they bear. Thus, for three drivers equally at fault, their respective insurers will each pay one-third of the damages for all claimants, whereas for two drivers of unequal fault, their liability might be split 70% and 30% and their insurance would pay for their share of the damages accordingly.

If an injured person is partly to blame, then under Missouri’s fault system, that person will not be able to recover the portion of their damages that corresponds to their portion of fault. As another example, if a claimant is 25% at fault for the crash, they will only be able to recover 75% of the total value of their damages from the other driver. On the other hand, if an injured person is entirely to blame for causing the crash and no other driver is at fault, then under Missouri law, they would be unable to recover any money for their injuries from the other drivers.

It’s also important to note that no matter who is at fault, insurance companies generally have 30 days to investigate a claim once it has been filed.

WHAT INSURANCE COVERAGE IS REQUIRED IN MISSOURI?

The State of Missouri requires every driver to carry certain amounts of insurance coverage.

Required liability insurance coverage:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

- $25,000 for property damage

Required uninsured motorist coverage:

- $25,000 per person for bodily injury

- $50,000 per accident for bodily injury

Uninsured drivers or drivers who do not carry or meet the minimum Missouri car insurance requirements can have their driver’s license suspended by the State. If a driver without the minimum required insurance causes more damage than they can afford to pay, they may be subject to a lawsuit and potentially a very high judgment.

HOW TO DETERMINE IF YOU NEED A CAR ACCIDENT LAWYER

Determining who is at fault for causing a Missouri car accident is not always black-and-white. It can depend on the facts – how the wreck happened – as well as what the police report shows and what any witnesses may have seen. By now, you can probably see how this plays a role in determining what insurance coverage applies and whether there will be any limitation on recovery.

If you or a loved one has suffered injuries as a result of an auto accident in St. Louis, a car accident attorney such as those at Brown & Crouppen can help by determining what insurance policies may provide coverage for your injuries and damages, helping you build a strong car accident claim, and recovering compensation for damages.

About the author: Mark C. Johnson is a personal injury attorney based out of St. Louis, Missouri, who practices in Missouri and Illinois with Brown & Crouppen. Connect with him on the web.