Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

Determining Fault in Property Damage Claims

Liability is the starting point for any property damage claim after a car accident.

- Your fault: If you caused the accident, your own insurance company may be able to help cover the costs of your property damage. However, it will depend on the type of coverage you carry. If all you carry is liability, you’ll have to pay for your own repairs. If you have an insurance policy that includes collision, you will pay the deductible and your policy will cover the rest. For more information, see our guide on what to do if an accident is your fault.

- Another driver’s fault: If the accident was caused by another driver, their insurance company should pay to repair your car. If that driver is uninsured, you can file a claim with your own policy if you carry collision.

- Uninsured driver’s fault: If the driver that caused the accident is uninsured and you only carry liability, you will have to pay for your own repairs. Uninsured motorist coverage only applies to injuries, not to property damage.

- The fault of a non-driver. Occasionally, accidents happen for reasons beyond the control of any driver. Animal strikes, dangerous potholes, and other circumstances can cause significant damage to both vehicle and occupant: Whether there will be insurance coverage will depend upon the unique facts of each case.

Can Your Vehicle Be Fixed? Total Loss vs. the Cost of Repair.

After deciding fault, an insurance company will weigh the cost of the repair against the fair market value of your car. If the cost of the repair is close to or exceeds the fair market value, the insurance company may decide to total your car, rather than repair it.

If a vehicle is totaled, the insurance company will issue a check to the legal owner of the vehicle, after satisfying any liens on the vehicle.

- The owner vs. the bank. Many owners receive an unpleasant surprise when their car gets totaled—if there is a loan on the vehicle, the bank gets paid first. GAP insurance can cover the difference, if you have it. If you don’t have GAP insurance, you are unfortunately on the hook for the balance of the loan.

- The owner vs. the driver. Many drivers use a vehicle that doesn’t legally belong to them. For example, if the car you drive is in your mother’s name, and it gets totaled, the insurance company will reimburse her, not you.

If your vehicle will be repaired, here are some things you should know.

- You are entitled to your own estimate. You can and should get your own estimate to determine how much damage your car has sustained.

- The insurance company is entitled to their own estimate. The insurance company can accept your estimate if they choose to do so, but more often, they will send out an adjuster, take the vehicle to a specific auto body shop, or both.

- You can get your vehicle repaired anywhere you want, but the insurance company will only pay for the estimate they deem appropriate. Insurance estimates typically come in lower than the estimates that drivers receive. This does not necessarily mean that the insurance company is skimping on repairs. Often, it is simply a reflection of the lower labor rates that insurance companies negotiate with their chosen auto repair shops.

- “Betterment.” Betterment is another factor that can lower the insurance company’s estimate of a repair. If you have an older model vehicle that is being repaired with brand-new parts, the insurance company may claim that the repairs will increase the value of your vehicle and reduce the value of your claim. The reduction should be limited to the difference between a used part and a new part.

- The insurance company can legally use aftermarket parts for your repairs. The law does require that any after-market parts installed on your car be clearly identified in the estimate. The Federal Trade Commission says that aftermarket parts should not void any warranty.

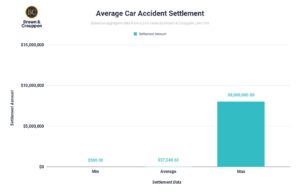

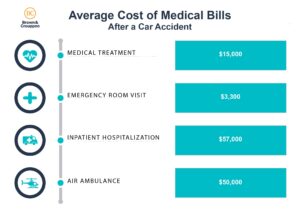

In many cases, injuries from car accidents are common and are a factor when determining how much compensation a car accident claim will pay out to the victim..

Car Rental

If you have no other vehicle available to you while your car is being repaired (or totaled), you may be entitled to have the costs of a car rental reimbursed. This can happen one of two ways.

- If you go through your own policy. Car rental is often not included in “full coverage” policies. It is usually an add-on that increases the monthly premium.

- If you go through the policy of the other driver. Even if the other driver was at fault for the accident, that driver’s insurance policy is not required to pay upfront for your car rental. Although some companies choose to do so, it is more often the case that the company will reimburse you after the fact. Insurance companies cap the daily rental rate they will reimburse, so go with least expensive option that suits your needs.

How Brown & Crouppen Law Firm Can Help

If you or a loved one has been injured in an accident, we may be able to help you recover compensation for damages, including property damage. Our car accident attorneys have helped our clients recover over $1 billion in compensation and have 10 convenient office locations throughout the Midwest including offices in St. Louis and Kansas City.

Getting started with your cases is easy. Call 888-801-4813 or request a free case evaluation online. And remember, there’s no upfront cost to you — if you don’t get paid, we don’t get paid.