Auto accident settlements often do not exceed policy limits because insurance companies are not required to pay out more than the amount of the policy limit. If your auto accident claim is significantly more than the policy limits, the insurance company will likely settle the claim for the amount of the policy limit.

However, there are cases where the settlement amount awarded to victims exceeds the policy limit.

Auto Insurance Coverage & Policy Limits in Missouri

First, it’s important to understand insurance coverage requirements in the state of Missouri. at-fault state, Missouri residents are required to carry minimum liability coverage. To operate a vehicle in the state of Missouri, it must be insured by meeting the state’s minimum liability coverage requirements.

Here are the minimum car insurance requirements in Missouri:

- $25,000 of bodily injury liability coverage (per person)

- $50,000 of bodily injury liability coverage (per accident)

- $25,000 of property damage liability coverage

- $25,000 per person and $50,000 per accident of uninsured motorist bodily injury coverage

These are just the state’s requirements; lenders may require additional insurance coverage.

To understand the likelihood of settlements exceeding policy limits, it’s important to understand exactly how policy limits are defined. Policy limits are the maximum amount an insurance company will pay out in the event of an accident. For example, if a policy limit is $50,000, the insurance company will not pay more than $50,000 for damages and injuries resulting from an accident.

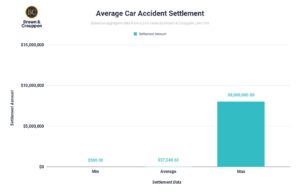

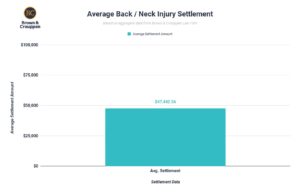

In many cases, settlements are made within the policy limit. However, there are instances where settlements may exceed the policy limit. This can occur for various reasons, including the severity of injuries sustained, the cost of medical treatment, the level of property damage, and the extent of liability. When a settlement exceeds the policy limit, the victim may be left with unpaid expenses or damages.

According to a study conducted by the Insurance Research Council, in 2014 the frequency of auto accident settlements exceeding policy limits was approximately 4%. This means that in 4% of cases, the settlement amount awarded to the victim was higher than the policy limit set by the insurance company. The study also found that the frequency of settlements exceeding policy limits varied depending on the severity of the accident. For example, in cases where the injuries were severe or resulted in a fatality, the likelihood of a settlement exceeding the policy limit was much higher than in cases with minor injuries.

Were you injured in an accident due to someone else’s negligence? Get legal help from the most effective injury law firm in the Midwest.

Collecting Additional Damages & Exceeding Policy Limits

Umbrella Policy

An umbrella policy provides additional liability coverage beyond the limits of your auto insurance policy. For example, if you have $40,000 in damages and the driver only has $25,000 in bodily injury liability coverage, the umbrella policy will cover the remaining damages.

Multiple Defendants

If the collision involved a commercial vehicle such as a semi, bus, or company car, you may be eligible to pursue claims against the driver and the company to recover damages. Similarly, if multiple drivers were found to be at fault for the accident, you may have the option to file a claim against each driver.

Bad Faith Claims

A bad faith claim is made against the insurance company if it is believed that the insurance company has acted in bad faith by failing to fulfill their contractual obligations under an insurance policy.

When you purchase an insurance policy, you enter into a contract with the insurance company. The insurance company is obligated to act in good faith, meaning that they must act in a reasonable, fair, and timely manner when processing claims and providing coverage. If an insurance company unreasonably denies a claim, delays payment, or fails to investigate a claim, they may be considered to have acted in bad faith. The consequences of a bad faith claim can be significant for the insurance company, requiring them to pay additional damages and penalties beyond the original policy coverage.

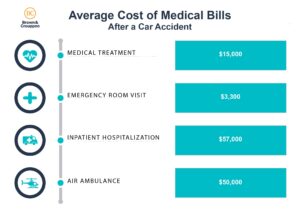

Additional Notes on Exceeding Policy Limits

Obligation of insurance companies: It is worth noting that when a settlement exceeds the policy limit, the insurance company is only responsible for paying the policy limit amount. The remaining balance is the responsibility of the at-fault driver. In cases where the at-fault driver is unable to pay the remaining balance, the victim may be left with unpaid expenses or damages. This is why it is essential to have adequate uninsured and underinsured motorist coverage to protect yourself in the event of an accident where the at-fault driver is unable to cover the full cost of damages (including medical bills resulting from the accident).

Uninsured motorist coverage: In the event that the driver responsible for the accident (and resulting damages) has no insurance, they are still entitled to Missouri’s uninsured motorist coverage, which protects an insured individual who is injured in an accident caused by a driver who had no insurance. Furthermore, the state’s “No Pay, No Play” law prevents uninsured motorists from pursuing non-economic damages after an auto accident.

Deadline to file a claim: It’s also important to note the Missouri’s statute of limitations for car accidents, which limits the time individuals have to file a claim to 5 years from the date of the accident or date that injuries were discovered.

Get Help from a Missouri Auto Accident Lawyer at Brown & Crouppen Law Firm

While settlements exceeding policy limits are relatively uncommon, they can still occur in severe or catastrophic accidents. It is crucial to understand your insurance policy and ensure that you have adequate coverage to protect yourself in the event of an accident. If you have been involved in an accident and are unsure of your coverage, get help from an auto accident lawyer at Brown & Crouppen Law Firm. An attorney can help guide you through the auto accident settlement process and help you secure the compensation you deserve.

Get started with your case by requesting a free case evaluation online.