Factors that Affect the Settlement Amount from a Drunk Driving Accident Claim

1. Insurance Coverage

If the at-fault drunk driver carries only the state minimum coverage ($25,000 per person / $50,000 per incident in Missouri, Illinois, and Kansas), then you may be looking at a $25,000 settlement offer (assuming you actually sought treatment for injuries related to the wreck). However, there may be more insurance that is available through the driver (through a higher policy or if there’s additional insurance available for the driver or vehicle) or through your own policy. If the drunk driver does not have any insurance, then you can file a no-fault claim under your own uninsured motorist (UM) coverage (which is required when you buy insurance in Missouri, Illinois, and Kansas). If the drunk driver carries insurance but not enough to cover your medical bills/injuries, then you can file under your own underinsured motorist (UIM) coverage. While UIM coverage is not required, it can be critical in ensuring you get an appropriate settlement considering your injuries.

2. Fault / Liability

Drunk driving is a significant form of negligence. If the other driver was intoxicated, it is easier to establish their fault in the accident. This can simplify the process of proving liability, which is a critical component of any personal injury case. Many jurisdictions have laws that presume a driver is negligent if they are proven to be intoxicated at the time of the accident. This presumption can make it easier to win your case or negotiate a favorable settlement.

How much money an injured person receives in a settlement is based on two primary considerations: how severe the injuries are and who is at fault for those injuries. If you are at fault for the crash, then naturally, the other party does not have to pay for the resulting injuries. Just because the other driver was intoxicated does not automatically mean that they are at fault for the crash. However, it does seriously impact their credibility when they try to tell their version of events.

The concept of fault in a motor vehicle collision is essentially the same across the United States. Whose actions (or inactions) caused the wreck? However, state laws vary on how you calculate damages based on fault. Missouri follows “pure” comparative negligence laws, which abide by the rule that the plaintiff’s percentage of fault reduces their compensation award, regardless of what their percentage of fault is. Under pure comparative negligence models, the injured party may receive compensation for their injuries even if they were more than 50% at fault for the wreck, though their recovery will be reduced by their shared percentage of fault. Missouri is a pure comparative fault state.

Some crashes make determining fault an “open and shut” case. If you are stopped at a red light and rear-ended, there’s little to no way that the other party can claim you were at fault. Likewise, if you are riding as a passenger in an accident, the fault can very rarely be shifted to you (unless, for example, you are pulling on the steering wheel or causing such a serious disruption in the vehicle as to prevent the driver from operating the vehicle safely. However, if you are driving within the speed limit and a vehicle cuts in front of you and then brakes abruptly, then you may be able to establish fault with the other driver, either partially or entirely (but you have the burden of proof).

3. Economic & Non-economic Damages

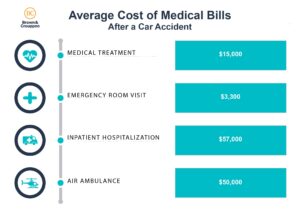

Medical Bills: As the injured party making a claim, you have the burden of proof not only that the other party is at fault for your injuries but also that you suffered the actual injuries, that the incident caused the injuries, and that you experience symptoms and limitations as a result of your injuries. The insurance company will not take you at your word. They want to pay as little as possible on your claim. You can prove your injuries and limitations by providing medical bills and records as well as information from your employer for lost wages (or tax returns if you are self-employed). You may also provide contact information for witnesses to the incident in question or “damages” witnesses who can speak to how you functioned before the incident versus after with your related injuries. However, the medical bills and records are generally the most credible (i.e., believable) evidence of your injuries.

Lost Wages or Loss of Business Expectancy: If you work as a W-2 employee with a regularly scheduled hourly job, then calculating lost wages is fairly straightforward. How many days (hours)you miss because of the wreck (either to recover or to attend medical appointments) is multiplied by your wage. However, much of the U.S. workforce performs work that isn’t compensated for in this traditional manner. An experienced plaintiff’s lawyer can assist in calculating lost wages or loss of business expectancy (where the injured party owns a business and loses clients or contracts as a result of their injury).

Pain and Suffering: In our civil justice system, the only recovery that the injured party can demand is monetary compensation. Money can never make an injury whole, and given a choice, injured parties would rather never experience the pain and limitation of their injury rather than receive any amount of money. However, like an egg that cannot be unscrambled, the courts cannot take away the injury itself. What they do allow is for the at-fault party to provide monetary compensation to the injured person as a means of accountability.

Property Damage: Obtaining repair or replacement estimates is crucial when making a property damage claim. Insurance companies may require multiple estimates to ensure accuracy and fairness in the evaluation of the claim. Obtaining your own estimates can help ensure obtaining a fair and reasonable estimate for the value of the vehicle if the car is determined to be a total loss. Beyond the immediate repair costs, consideration must be given to the diminished value of the damaged property. This aspect acknowledges that even after repairs, a vehicle may not command the same market value as it did before the accident. Insurance policies often include provisions for a rental car while the damaged vehicle is being repaired. Confirming and understanding the terms of this coverage helps alleviate the practical challenges posed by the unavailability of one’s primary means of transportation.

Example Case Settlement Amounts Impacted by Drunk Driving

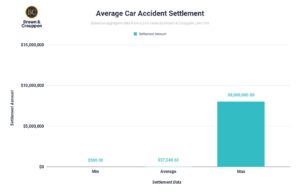

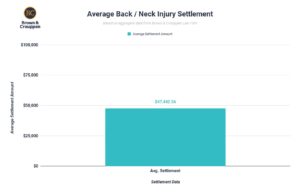

Courts and insurance companies often view drunk driving accidents more seriously. This can result in higher compensation for victims due to the aggravating factor of impaired driving. You might be entitled to compensation for medical bills, lost wages, pain and suffering, and sometimes punitive damages intended to punish the drunk driver. Therefore, insurance companies are often more willing to settle quickly and for a higher amount when their insured driver was drunk. They recognize the potential for a significant verdict if the case goes to trial, which can give you leverage in negotiations.

For example, if someone was injured in a car wreck and only got checked out at the emergency department, that person can expect to have that ER bill paid and maybe a few hundred dollars on top of that. That person probably isn’t going to get a settlement offer over $10,000 total. However, if the at-fault driver was charged with a DUI in connection with the incident, then the injured party could realistically get a $25,000 settlement offer (particularly if that is the at-fault driver’s limits). Insurance adjusters know that juries hate drunk drivers and are going to be more sympathetic to the plaintiff’s injuries if the defendant drove under the influence.

In a situation where there’s a light dispute, meaning you allege you had the green light at an intersection but the defendant swears they had a green light/arrow as well, if the other driver was found to be intoxicated at the scene, their credibility is severely weakened, and it will be significantly less likely for a jury to believe their side of the story. In a typical light dispute case, where the only evidence is the testimony of each driver that they weren’t at fault, it is unlikely that the jury will believe the driver who was intoxicated simply because they got behind the wheel after drinking. This could change the liability determination from 50-50 (and therefore cutting the settlement offer in half) to 100% in favor of the sober driver. For more information, see additional DUI settlement data & examples.

Get Help with Your Personal Injury Case from Brown & Crouppen Law Firm

If you or a loved one has suffered injuries from a drunk driver, you may be eligible to receive financial compensation for lost wages, medical expenses, pain and suffering, and other damages. Getting started is easy. Get help from our legal team by calling us at 888-795-0694 for a free consultation, or get in touch with a Brown & Crouppen attorney by requesting a free case evaluation online. And remember, there’s no upfront cost to you — if you don’t get paid, we don’t get paid.