Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

Insurance Claim Timeline

Day 0: After contacting an attorney at Brown & Crouppen, our staff will gather essential information about your claim, injuries, and the events surrounding the incident. This can include, but is not limited to, police reports, photographs, and medical records.

Day 1–10: Once your claim is filed, insurance companies are required to acknowledge receipt of the claim within 10 business days. While this does not guarantee a settlement offer, it initiates their investigation process. Sometimes, insurance companies may deny liability or delay the process for damages. If this occurs, your attorney will follow up to uncover the reasoning behind their decision and address any issues.

Day 10–30: After acknowledging the claim and receiving the claimant’s information, insurance companies typically have 15 business days to decide whether to accept or reject the claim.

Day 30 and Beyond: If the insurance company requests an extension, they must provide a valid reason for the delay. In some cases, insurers may respond by requesting additional information or asking follow-up questions to clarify details. Attorneys are experienced in responding to delay tactics, and know how to ensure your rights are protected throughout the car accident settlement process.

If a settlement offer is provided, your attorney will inform you on next steps, this can include settlement negotiations with the insurance company to maximize the compensation. Your attorney can make counters that expand on the strengths of your case, and clearly explain to the insurance company why their offer is insufficient or unfair.

How an Attorney Can Help With Your Claim

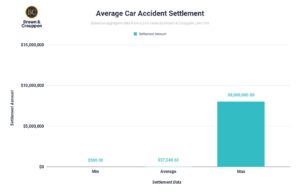

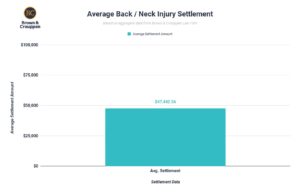

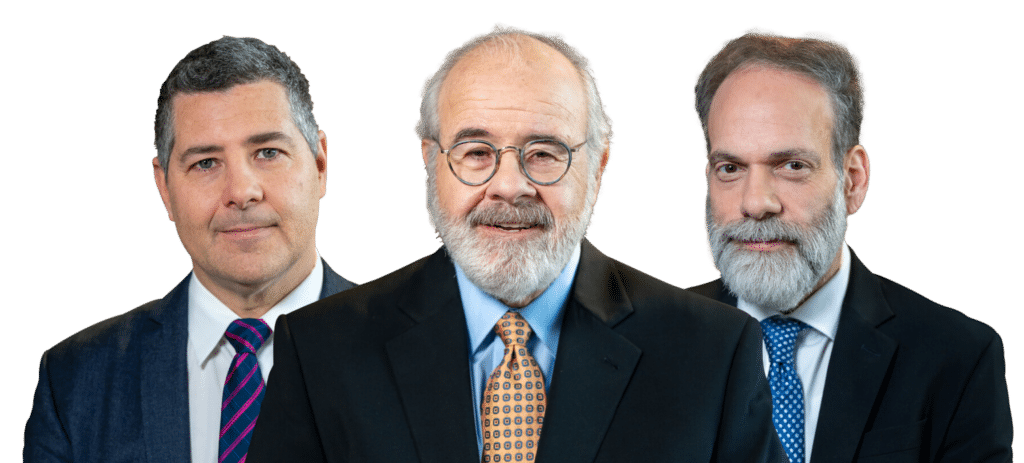

Each case is unique, and the amount you may receive from your claim will vary depending on the severity of the car accident, accompanying injuries, and other case factors detailed below. Our personal injury attorneys have helped thousands of individuals recover compensation for injuries. If you or a loved one is experiencing an injury or symptoms as a result of a personal injury, you may be entitled to compensation. Getting started with your case is easy. Call 888-801-4813 or request a free case evaluation online. And remember, there are no upfront costs or legal fees – we only get paid if you win

Factors That Can Impact Claim Investigations

#1 Complexity of the Incident

Claims involving multiple injured parties, multiple tortfeasors, extensive injuries or damages, or unclear fault can take longer to investigate. This often requires insurance companies to wait for all necessary information from all parties involved in order to conduct a thorough investigation.

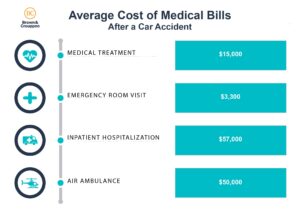

#2 Injuries and Medical Treatment

Claims involving serious injuries may require prolonged medical treatment. Ongoing treatment can keep a claim open until the full extent of the injuries and associated medical expenses are determined.

#3 Liability

#4 Insurance and Coverage

Steps to Take if Your Claim is Delayed or Denied

When your claim is being delayed or denied, your attorney can guide you on next steps.

Your attorney may suggest alternative dispute resolution methods, such as mediation or arbitration. Mediation involves a neutral third party who facilitates discussions between you and the insurance company to reach a resolution. Arbitration, on the other hand, is a more formal process where both parties present testimony and evidence to a third party, who then delivers a binding decision.

If your claim is being unfairly delayed or denied, the Missouri Unfair Claims Settlement Practices Act protects policyholders from improper claims practices. The determination of bad faith is a question of fact, assessed on a case-by-case basis. Generally, bad faith occurs when an insurer engages in improper conduct to minimize payouts. Under Missouri law, policyholders may pursue legal action for bad faith refusal to settle, potentially recovering compensation beyond the original claim amount. You have five years to file such an action. Consulting an attorney can help determine if this is the best course of action for your situation.

If no agreement can be made, the next step is litigation. This can delay the compensation significantly, at times, for several years. Your attorney will advise you on their recommendations based on their experience and investigation of your claim. While the idea of going to trial can be daunting, our goal is to ensure you’re fairly compensated for your injury.

Get Help from A Personal Injury Attorney at Brown and Crouppen

When dealing with a personal injury insurance claim, it is crucial to consult with an experienced attorney that can guide and advise you through the claim. Early legal intervention can help protect your rights and improve your chances of compensation. Our legal team is here to help you learn more about your legal options and evaluate the strength of your accident claim. We care about our community and have dedicated our practice to helping injury victims recover justice, accountability, and compensation Get started today with your free case evaluation by visiting Brown & Crouppen online or by calling us at 888-801-4736.

Our St. Louis and Kansas City personal injury lawyers have helped clients recover over $1 billion in settlements and verdicts. And remember, there are no upfront costs or legal fees – we only get paid if you win.