Can I Sue Someone for Totaling My Car?

Yes, you can sue someone for totaling your car. If you were in a car accident caused by another party’s negligence or recklessness, you likely have the right to sue them for damages related to the accident, including the cost of replacing your totaled vehicle.

However, even when you know what to do after an at-fault driver totals your car, the process of filing a lawsuit can be grueling. You may be tempted to just accept the first settlement the other driver’s insurance provider offers to get it over with and replace your car as soon as possible.

However, going through the complicated legal process of seeking recovery for your totaled car doesn’t have to be difficult. The experienced Missouri car accident attorneys at Brown & Crouppen know how hard it is to fight insurance companies for compensation after your car is totaled. We take the weight off our clients’ shoulders, doing the heavy lifting while they focus on moving on from the car accident.

What Are the Steps To Take After My Car Is Totaled?

After your car has been totaled in an accident, take appropriate action to preserve your legal rights. Follow these steps to fulfill your legal duty as a driver involved in an accident and maximize your compensation.

1. Report the Accident to the Appropriate Authorities

Missouri law requires drivers involved in an accident to stop at the scene and wait for law enforcement to arrive. Additionally, Missouri drivers are legally required to report accidents to the Drivers License Bureau if they involve an uninsured driver and result in $500 or more in property damage.

Beyond your legal responsibilities, reporting an accident to the police is always in your best interest if your vehicle has been totaled. The police will generate an accident report containing complete information about the parties and vehicles involved, the scene of the accident, and witnesses to the crash. The accident report will also include forensic data and photos of your vehicle at the scene. All of this information is critical when filing an insurance claim for a totaled car.

2. Gather Evidence and Document the Scene

3. Notify Your Insurance Company

4. Get a Professional Valuation of Your Totaled Vehicle

Knowing how much your car is worth when suing for a total loss is important. Insurers will determine whether the car has been totaled based on its actual cash value. Your car’s actual cash value is determined by subtracting your car’s depreciation over time from its initial worth, relying on factors like age, mileage, overall condition, resale value, and current market price for similar cars.

Don’t rely on insurers to accurately assess your car’s actual cash value. It’s in the insurer’s best interest to assign the lowest possible value to avoid higher payouts. By consulting professional resources like the Kelley Blue Book and contacting local dealerships, you can come to an independent conclusion about how much your car is currently worth.

5. Reach Out to a Knowledgeable Car Accident Attorney

Reaching out to our knowledgeable car accident attorneys as soon as possible after an accident is always recommended. An attorney can assess your case, determining the extent of your legal needs and how much you may be eligible for in damages.

Time is of the essence when seeking legal representation. The Missouri car accident statute of limitations is normally five years from the date of the accident. That may seem like a long time, but it becomes more difficult for your legal team to gather critical evidence, such as witness testimony, every day that goes by. Contacting an attorney early on gives you the best chance at securing full and fair compensation.

How Do I Deal With Insurance Companies After My Car Is Totaled?

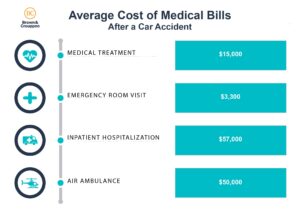

What Damages Am I Eligible To Receive After My Car Is Totaled?

Hire an Attorney for Your Totaled Car Claim

If your car has been totaled in a car accident in St. Louis or Kansas City, don’t wait to secure high-quality legal assistance. The knowledgeable car accident attorneys at Brown & Crouppen are here to help.

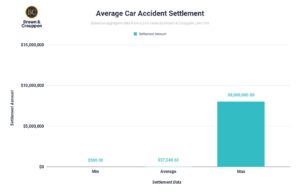

With over $1 billion recovered in high-value case results for our clients, our experienced attorneys have what it takes to protect your rights every step of the way. Call (800) 536-4357 or contact us online for your free legal consultation.