Use our legal checklist to learn what to do after an accident and understand key legal considerations for recovering financial compensation.

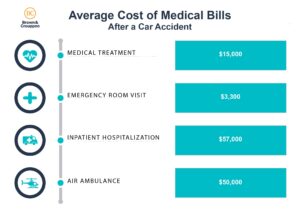

If you’re in a car accident caused by another driver but don’t have car insurance, you may still be eligible to seek compensation for economic damages such as medical expenses, lost wages, and property damage. However, driving without insurance can lead to legal penalties and may restrict the types of damages you can recover. Additionally, handling claims without your own insurance company can make the process more complex.

Exceptions To Missouri’s “No Pay, No Play” Law

In some cases, there are exceptions to Missouri’s “No Pay, No Play” law. For example, the law only applies to drivers, not passengers. Therefore, if you do not carry auto insurance and are riding in a vehicle with an uninsured driver, you are not limited to economic damages only and can make a claim for pain and suffering. Additionally, the law does not apply where the driver had become uninsured within the last six months prior to the crash for failure to pay their premium. It also doesn’t apply if they had a reasonable belief that they were insured because their auto insurance carrier failed to properly notify them that their coverage would be lapsing.

The Missouri Financial Responsibility Law provides that all drivers must carry the minimum insurance coverage requirements while driving. Missouri requires that each driver carries bodily injury liability coverage of at least $25,000 per person and $50,000 per incident. This means no one injured person receives more than $25,000 when there is minimum coverage, and the carrier is not required to pay out more than $50,000 for all injured persons in one incident, regardless of how many injured parties there are and how severely injured they are. The law also requires that all drivers carry uninsured motorist coverage, which has the same minimum coverage of $25,000 per person, and $50,000 per incident.

The purpose of the law is to protect drivers and passengers in the event that a crash occurs (see Missouri’s uninsured motorist coverage statute). When a driver fails to carry insurance and causes a car crash, then the injured party’s uninsured motorist coverage kicks in and pays for the bodily injury damage. Note that uninsured coverage only applies to bodily injury, not property damage. If you are hit by an uninsured driver, then your property damage will be covered by your insurance only if you carry comprehensive collision coverage, often referred to as “full” coverage.

However, in some instances uninsured drivers get into a wreck while not being at fault. Historically, so long as the at-fault driver was insured, then the uninsured driver could make a bodily injury claim. However, in 2017 the Missouri legislature passed a law that seeks to limit an uninsured driver’s ability to make bodily injury claims. The law only allows uninsured motorists to make claims for “economic damages,” i.e., medical bills and lost wages, while prohibiting claims for “non-economic damages,” commonly referred to as pain and suffering.

If you or a loved one has been injured in a car crash due to another person’s negligence, get help from a car accident lawyer in St. Louis by requesting a free case evaluation from Brown & Crouppen Law Firm.